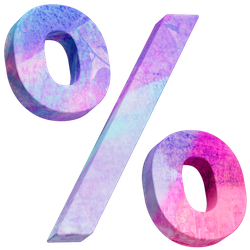

Applied Microbiology | Free Full-Text | Antioxidant, Antimicrobial and Cosmeceutical Potential of Wild Mushroom Extracts

bug - Currency field displayed with different currency depending on language parameter in Visualforce page! - Salesforce Stack Exchange

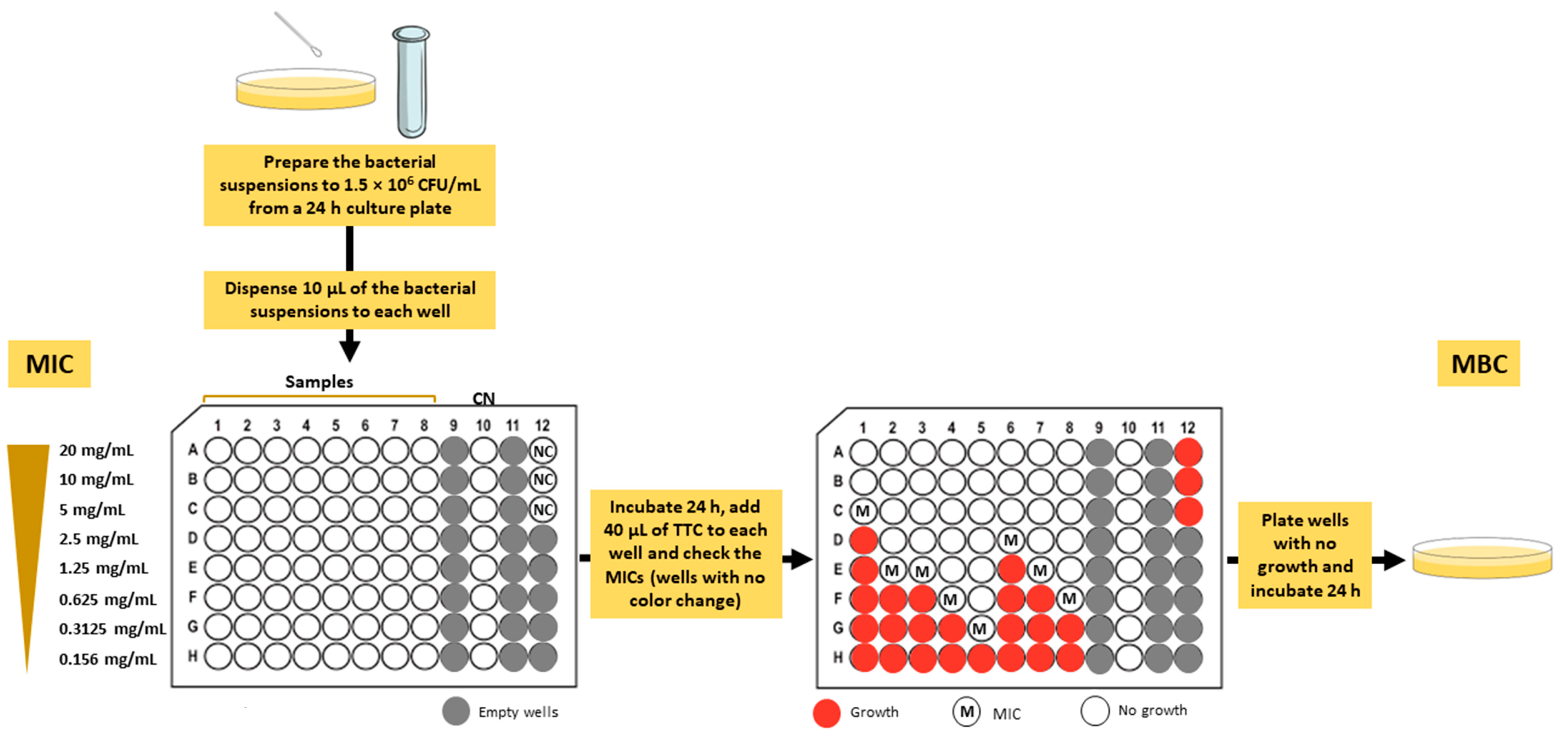

IJMS | Free Full-Text | PollenDetect: An Open-Source Pollen Viability Status Recognition System Based on Deep Learning Neural Networks

PDF) The Effects of Growth Modification on Pollen Development in Spring Barley (Hordeum vulgare L.) Genotypes with Contrasting Drought Tolerance

Rapid evolutionary repair by secondary perturbation of a primary disrupted transcriptional network | EMBO reports